When you buy a Strata titled property you are buying your own apartment, but you are also buying a piece of the entire complex itself, including a portion of the common property. The common property includes things that are common to all, for example walls, external roof, foyers, pools, car parks and gardens. Those areas are shared between all the owners of the strata company and are managed by the body corporate.

Shazam Casino Review, with its mystical allure and generous bonus offers, provides an engaging and reliable online gaming experience. From its extensive game library powered by top-tier providers to its robust security and exceptional customer support, this platform has a lot to offer both new and seasoned players.

A certain amount of money is required to look after the day to day running of the strata property, maintenance and special expenses and your strata levies and strata fees are the amount collected by each owner to contribute to that pool.

What is a strata levy or strata fees?

Strata levies are contributions that are paid by the owners of lots in a strata scheme to help fund the costs of maintaining and managing the common areas of the building and the property. These costs can include things like administrative fees, insurance, repairs and maintenance, cleaning/gardening, and utilities for common areas such as hallways, elevators, and other shared facilities.

Strata levies are typically paid on a regular basis, such as monthly or quarterly, and are determined by the owner of the strata company (the governing body of the strata property) at each Annual General Meeting (AGM). The amount of the strata levies set, is usually based on the funding requirements for the Strata Company’s budget that is also set at the AGM. The levies are collected by the Strata Company and used to pay for the ongoing costs of running and maintaining the property.

What is included in strata fees or levies?

Strata Levies cover a wide number of things depending on your unique Strata Property and inclusions. Some things you may be paying for include:

1. Maintenance and repair: Strata fees cover the cost of maintaining and repairing common areas and facilities such as elevators, hallways, lobbies, and parking lots. This includes regular cleaning, painting, and upkeep to ensure that these areas are clean and safe for residents.

2. Utilities: Fees may also include the cost of utilities such as water, electricity, and gas for common areas. This can include lighting in shared spaces, heating and cooling systems, and water usage for communal areas such as swimming pools or gardens.

3. Insurance: Strata fees also cover the cost of insuring the building or complex, including liability insurance for common areas and public spaces. This provides protection in the event of any accidents or damage to the property.

4. Management fees: Part of the fees may be used to pay for the services of a property management company, which handles administrative tasks such as collecting fees, organizing repairs, and enforcing strata rules and bylaws.

5. Reserve fund: A portion of the fees is generally set aside in a reserve fund, which is used to cover unexpected expenses or major expenses.

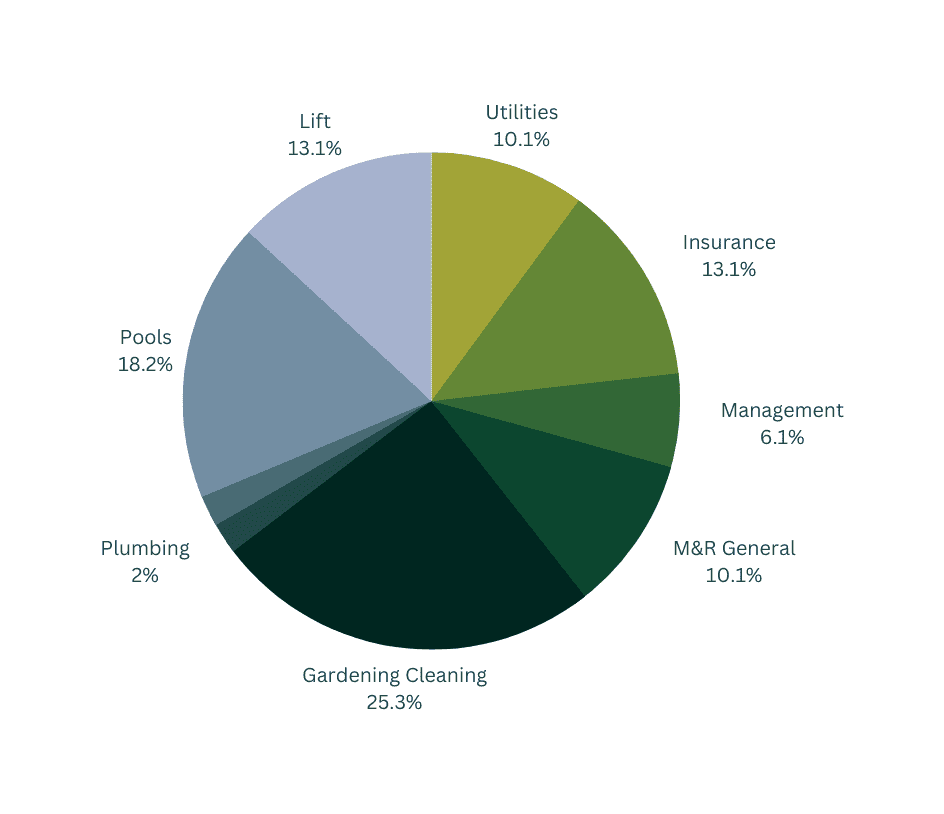

Below is a sample breakdown of what strata levies cover for a building of 10 – 19 lots.

Are all strata levies the same for all properties?

Every building has a unique set of attributes that require different amounts of maintenance. For example, if you own a Survey Strata property, there is less common property to maintain as a strata company, and therefore the amount of funds required to running them will be lower. Buildings with pools, lifts, building managers etc, will require more funds for the management but they will be spread out over all the owners of the complex.

How much are my strata levies?

The amount of strata fees can range from a few hundred to several thousand dollars per month, depending on the size of the building, the number of units, and the level of services and amenities provided. For example, small, self-managed strata with minimal common areas and services may have lower fees than a larger, professionally managed building with on-site amenities such as a pool, gym, or concierge.

It is important for potential buyers to carefully review the strata documents, including the budget and financial statements, to understand the breakdown of strata fees and ensure they are comfortable with the costs. It is also important to note that strata fees may increase over time due to maintenance and repair costs, inflation, or other factors.

Overall, while strata fees may seem like an additional expense, they are an essential part of owning a strata property and contribute to the upkeep and value of the building as a whole.

What is my portion of the strata levies?

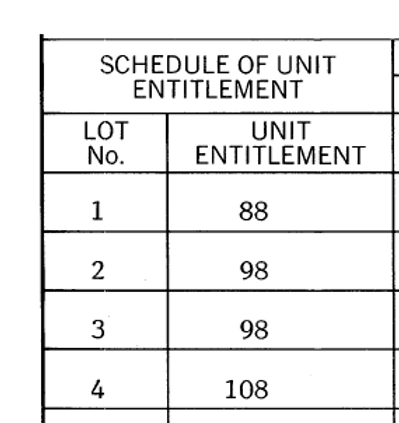

Every strata property comprises of many different lots. In order to determine each owner’s undivided share in the common property, voting rights, along with their share of outgoings, a unit entitlement is assigned to each unit. A unit entitlement represents each unit’s value as a percentage of the value of the whole development and your individual unit entitlement will govern how much you contribute financially to the running costs of your strata complex.

You can find your lot unit entitlement in your Strata Plan.

How are strata levies decided – and what to do if yours have increased?

Strata levies are decided by a simple majority vote at an Annual General Meeting based on the budget for the upcoming year. If you have received a quarterly levy notice which is higher than you were expecting, we would encourage you to refer to your minutes and its attached budget to learn more about the spending decisions made by your strata company.

Article: Levies and levy increases

How do you pay for strata fees or levies?

At ESM Strata, all levies are paid via the DEFT payment service and funds are held in individual accounts in the name of the Strata Company. This account is managed by ESM Strata on behalf of the Council of the Strata Company and the Strata Company. The levies raised fund the approved expenditure of your Strata Company.

What percentage of my strata levy fee is attributed to Strata Management?

Part of your strata fees may be used to pay for the services of a property management company such as ESM Strata, which handles administrative tasks such as collecting fees, organizing repairs, and enforcing strata rules and bylaws. This amount varies depending on the unique needs of your strata property, but a full list of common services can be found here.

Are strata fees tax deductible?

Strata fees are a common expense for many property owners, particularly those who own a unit in a strata-titled building. These fees cover the cost of maintaining and managing common areas, such as hallways, elevators, and shared amenities.

The question of whether strata fees are tax deductible is a common one, and the answer is not straightforward. Generally, strata fees are not tax deductible for most property owners. This is because they are considered personal expenses rather than business expenses.

However, there are some circumstances in which strata fees may be tax deductible. For example, if you own a rental property and the strata fees are a cost associated with earning rental income, they may be tax deductible. Similarly, if you use your property for business purposes, such as running a home office, you may be able to claim a portion of your strata fees as a tax deduction.

It is important to note that claiming strata fees as a tax deduction can be complex, and it is recommended that you seek professional advice from a qualified accountant or tax advisor. They can help you determine whether you are eligible to claim strata fees as a deduction and assist you in calculating the amount you can claim.

The Frequently Asked Questions we get about Strata Fees

How much are strata fees on average?

The amount of strata fees in Western Australia can vary significantly depending on the size of the property, the amenities provided, and the level of management required. On average, strata fees can range from $500 to $1,500 per quarter for residential properties. For larger or more complex developments with facilities like pools, gyms, or elevators, the fees can be higher, often reaching $2,000 or more per quarter.

When are the strata fees decided?

Strata fees, also known as strata levies, are typically decided at the Annual General Meeting (AGM) of the Strata Company. During the AGM, the council of the strata company, along with the owners, will approve the budget for the upcoming year. This budget outlines the expected expenses for maintaining the common areas, insurance, management fees, and any reserve funds needed for future repairs or upgrades. Based on this budget, the strata fees for each owner are calculated according to their unit entitlement.

What if I can’t afford to pay my strata fees?

If you are unable to pay your strata fees, it is important to act quickly and communicate with your strata manager or the council of the strata company. In some cases, you may be able to arrange a payment plan to spread out the cost. However, failing to pay strata fees can result in serious consequences, including late fees, interest charges, or legal action. The Strata Titles Act 1985 (WA) gives the Strata Company the right to recover unpaid levies, and it can also impact your ability to vote on decisions within the strata.

What if I don’t agree with where my strata fees are going?

If you disagree with how your strata fees are being allocated, the best course of action is to raise your concerns at the Annual General Meeting (AGM) or during any regular council meetings. All owners have the right to review the strata company’s budget, which should provide transparency on how fees are spent. You can also request detailed financial statements to better understand the expenses. If a majority of owners share your concern, changes can be proposed and voted on. If the dispute cannot be resolved internally, you may seek advice from the State Administrative Tribunal (SAT), which handles strata-related disputes in Western Australia.

Will strata fees go down or only up?

Strata fees typically fluctuate based on the needs of the property. While it’s more common for fees to increase over time due to inflation, rising maintenance costs, or unexpected repairs, they can potentially go down if the Strata Company reduces spending or if certain one-off expenses are no longer required. However, it’s important to note that ongoing maintenance, repairs, and future forecasting often mean fees are more likely to increase rather than decrease over time. The best way to ensure fees are kept manageable is through proper financial planning and maintaining a healthy reserve fund.