Managing the financial health of your strata company is crucial for maintaining the property and avoiding unexpected levy increases. This guide will help you better understand the Strata Company Financials and how to interpret them to ensure your strata company is in good financial shape.

How to read your company financials.

The ESM Strata team has assembled a detailed guide on how to interpret your Strata Company financials. Check it out here.

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of your strata company’s financial position at a specific point in time. It details the assets (what the company owns), liabilities (what the company owes), and equity (the total funds or “owners’ equity”). The balance sheet helps owners see how much working capital is available to cover daily expenses, maintenance, and emergencies.

To interpret the balance sheet, look at the total owners’ funds, which represent the working capital. This figure is important for understanding whether the strata company has sufficient liquidity to manage ongoing and unexpected expenses.

What is an Income and Expenditure Statement?

An income and expenditure statement shows the revenue your strata company has earned and the expenses it has incurred over a specific period. This statement is key to understanding the cash flow of the strata company, detailing:

- Income: Primarily from strata levies paid by owners.

- Expenditure: Costs like maintenance, insurance, utilities, and management fees.

By comparing income against expenditure, you can gauge whether the strata company is running a surplus or deficit.

How to Determine Financial Stability

A financially stable strata company should have a healthy balance between income and expenditure and maintain enough working capital (ideally between 25% and 35% of the total budget). This provides a buffer for emergencies or unexpected repairs without needing to increase levies drastically.

The total owners’ funds on the balance sheet reflect the working capital. A well-funded strata company will have a positive balance, indicating that it can manage day-to-day expenses and has reserve funds for larger repairs or improvements.

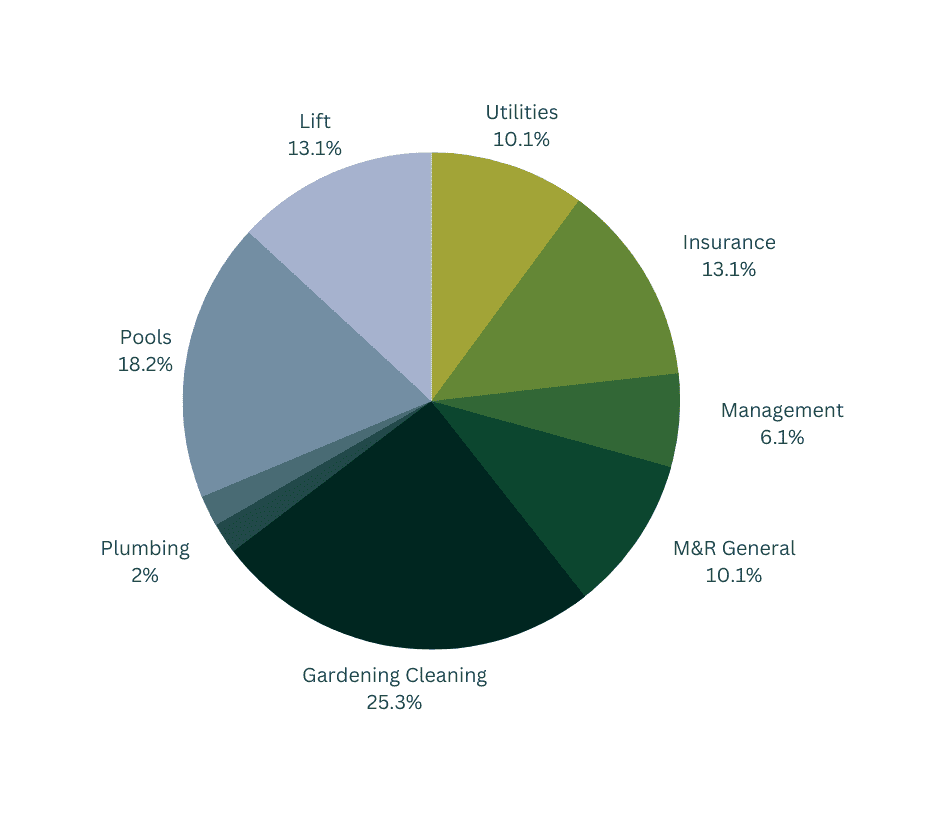

Common Expenses for Strata Companies

Some of the most common expenses covered by strata fees include:

- Building insurance

- Utilities for common areas (water, electricity, gas)

- Maintenance and repairs of common property (gardens, car parks, elevators, etc.)

- Management fees for the strata management company

- Reserve funds for future repairs or capital works

The largest portions of a typical strata budget often go to building insurance, utilities, and cleaning or gardening services.

Here is an example of an average property:

How Are Strata Levies Decided?

Strata levies are determined at the Annual General Meeting (AGM) of the strata company. Owners review the budget for the upcoming financial year, which includes anticipated expenses for maintenance, utilities, insurance, and management fees. Based on this budget, the required levies are set to cover these costs.

If the strata company has sufficient funds in reserve, levies may remain stable or even decrease. However, if the strata company expects higher expenses or needs to increase its reserve funds, levies may increase.

For more on how strata levies are calculated and the common expenses they cover, click here.

Budget vs. Levies

The budget of a strata company outlines anticipated expenses for the year. The levies are the fees owners pay to fund this budget. While the budget gives a foundation for cash flow requirements, the actual levies must also consider working capital needs, upcoming repairs, and reserve fund goals. Levies may vary depending on the strata company’s financial position and the needs of the property.

What is Working Capital?

Working capital is the liquidity available to the strata company to manage daily expenses like maintenance and repairs. It is calculated as the total assets minus total liabilities, and it appears as total owners’ funds on the balance sheet. A healthy working capital ensures that the strata company can meet its financial obligations without needing to request additional funds from owners unexpectedly.

Having between 25% and 35% working capital is a good indicator of financial health. If your strata company has this level of reserves, it is likely prepared for emergencies and unexpected repairs.

How to Access Your Strata Company Financials

Owners can access their strata company’s financial reports, including balance sheets and income statements, at any time through the strata company’s online portal. This allows you to stay informed about the financial stability of your strata and make better decisions at AGMs.

To download a copy of your strata financials, visit our online portal.

Need More Help?

If you still have questions about your strata company’s financials or how your levies are being used, feel free to contact your designated Strata Manager for assistance. They can provide a detailed explanation and help you better understand the financial health of your property.